No products in the cart.

Mergers and Acquistions

Management Practice

Learn how to develop a detailed and nuanced three-year M&A plan designed to deliver on-target profitable growth on-demand and on-time.

3X Equity in 3 Years!

Available 2024

Topics Covered by the Mergers and Acquisitions Practice

Acquisition Strategy:

Searching the market for a potential acquisition is a grueling process. The objective of this phase is to help you narrow your focus according to your company’s specific needs.

Sourcing:

Sourcing is the process of finding channels for potential deals. The objective is to develop and manage a consistent pipeline of potential targets that meet acquisition criteria.

Evaluation:

The objective of the evaluation phase is to perform a close analysis of one of the companies found during the sourcing process to determine whether or not it would be an optimal fit for the current portfolio.

Due Diligence:

The goal of due diligence in the M&A process is for the buyer to confirm the seller’s financials, contracts, customers, and all other pertinent information. In other words, the goal is to make the buyer comfortable enough that he/she goes through with the deal and closes.

Negotiation:

The negotiation phase often is the most complex part of the acquisition process. In this phase, you negotiate with the target agreement on transaction structure and terms. In most successful negotiations, parties to the transaction search jointly for solutions to problems. All parties must be willing to make concessions that satisfy their own needs, as well as the highest-priority needs of others involved in the negotiation.

Document & Close:

Document & Close follows the negotiation. In this stage, the buyer and seller make this agreement official by signing a legal binding contract. Additionally, there will most likely be some post-closing financial adjustments. The objective of documenting and closing the agreement is to ensure that the agreement is finalized and under legal protection.

Integration:

This integration step is widely viewed as one of the most important phases of the acquisition process. The objective of integration is to transition the acquired company into the parent company and ensure that it can continue to operate as a standalone business.

Transaction Measurement:

Transaction Measurement is the final stage of M&A. it follows the Document & Close and Integration because it primarily aids driving execution; and facilitating reflection and learning. The objective of the Transaction Measurement phase is to determine whether or not the acquisition is meeting expectations, establish corrective actions if necessary and to identify what was done well and what should be done better during future acquisitions.

Let Me Tell You More About

The Mergers and Acquisitions Process

PGOS's Merger and Acquisition (M&A) Management Practice is one of several tools that play a vital role in the execution of your strategy. From accelerating long-term growth to facilitating entry to new markets, M&A can be highly effective in achieving your most important strategic goals (e.g., growing the company and maximizing shareholder value). Your M&A strategy should be looked upon as an extension of your overall growth strategy.

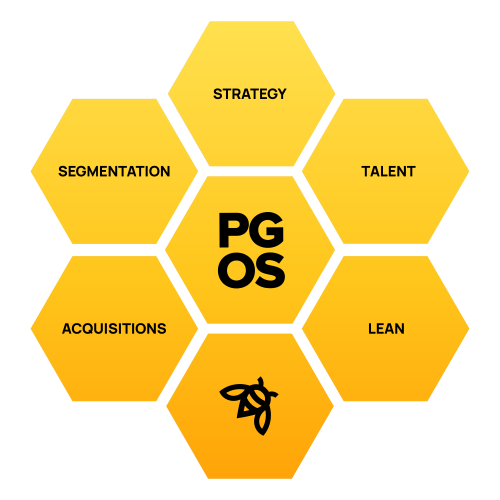

Profitable Growth Operating System

"Profitable Growth Operating System" (PGOS) details the structured M&A process designed to create long-term plans to achieve profitable growth. This process helps create a shared view amongst senior leadership about where the business competes effectively and how to best allocate resources in order to continue winning in the marketplace.

Part of the PGOS Library of Books

The Five Management Practices

1

Understand the principles of life coaching and how it differs from other disciplines such as therapy or counseling.

2

To separate the “critical few” from the “trivial many” and align everything and everyone in your business accordingly.

3

To continuously improve productivity by aggressively streamlining processes and relentlessly eliminating waste.

4

To attract, develop, and retain employees with the skills, knowledge, and mindset to drive profitable growth.

5

To profitably grow the business through the right acquisitions and strategic partnerships at the right time.

Over $3 billion in

Shareholder Value Created

Customers served! + 1 Operating Companies

Customers served! > 1 Countries

The Profitable Growth Operating System (PGOS) is a proven set of simple tools and processes to help middle-market companies profitably grow their businesses.

About Bill Canady

Bill Canady has been leading companies to profitable growth for over 30 years. Working in a variety of industries and markets focused on industrial as well as consumer products and services, he brings to the table a unique Operating System and uses it in a 100-day campaign to position the company for profitable growth. Combining vision and process, Canady aligns leadership and other critical stakeholders to earn the right to grow and then to claim that right with a 3-to-5-year business plan for targeted, strategic growth. He believes in bringing the right tools to the job and developing strong leaders and management teams to use them. His experience encompasses global public, private, and sponsor-owned firms.

Join The Beehive!

Sign up to receive thought inspirations, exclusive promotions, and updates from Bill Canady